LC Confirmation Financing

LC Confirmation

EDF is embarking on expanding the trade finance proposition to support the export transactions which are originated by the banks in the Member Countries . The direct beneficiary of this proposition are exporters who want to mitigate the credit and country risks of the LC Issuing Bank by availing the product.

The proposition is open to both the public and private sector beneficiaries who are exporting their goods to the OIC Member Countries. Given the importance of international trade for the economic development, this is an important intervention that EDF wants to drive in the coming years.

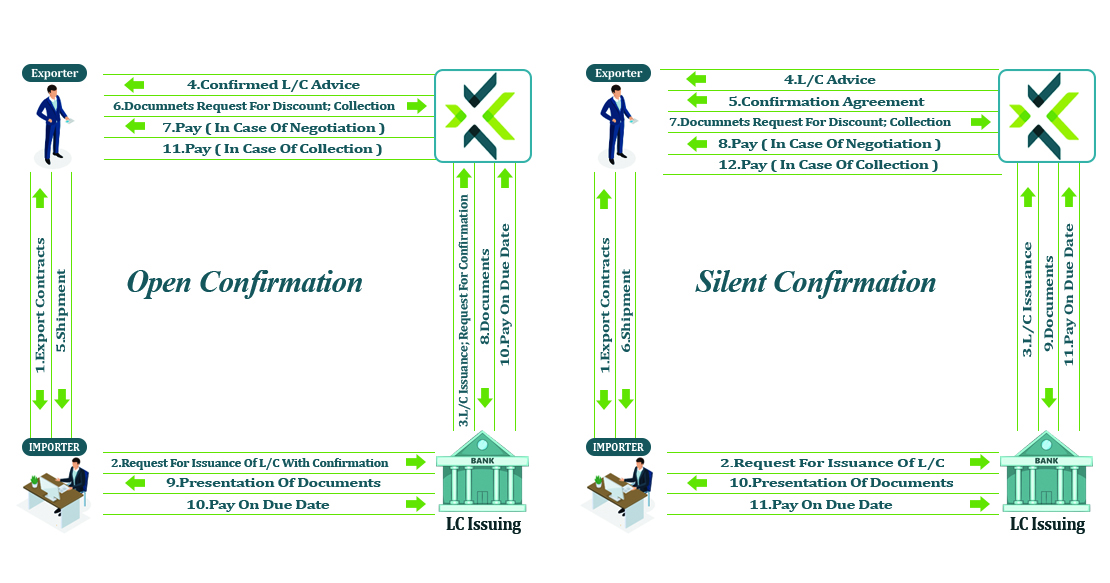

Oftentimes, the exporter wants payment assurance from an investment grade financial institution prior to shipping the goods. To support the smooth flow of international trade, EDF has launched an ‘LC Confirmation’ product to cater to the requirements of the exporters. The product, which is an un-funded trade solution, is designed with the view to supporting the cross-border trade and thus contribute to the economic growth of both the exporting and importing countries.

A Confirmation issued by EDF on a Letter of Credit is an undertaking, in addition to that of the LC Issuing Bank, to pay the exporter / supplier of the LC (i.e. Beneficiary) upon submission of complying documents. The solution allows the supplier to have assurance from a credible multi-lateral financial institution, i.e. EDF, to secure its payment on due date.

The direct beneficiary of this proposition are exporters who want to mitigate the credit and country risks of the LC Issuing Bank by availing the product.

How The Solution Works ?